What are we supposed to do with all of these packages?

It’s a sentiment that has echoed through leasing offices across the country since the emergence of Covid-19.

Package volume at multifamily communities has skyrocketed in recent months. In an effort to avoid public spaces including brick-and-mortar retailers, renters are increasingly turning to e-commerce for almost all of their shopping needs. As a result, online orders are piling up at apartment buildings, and finding storage space has become a constant and often unfeasible task for property managers.

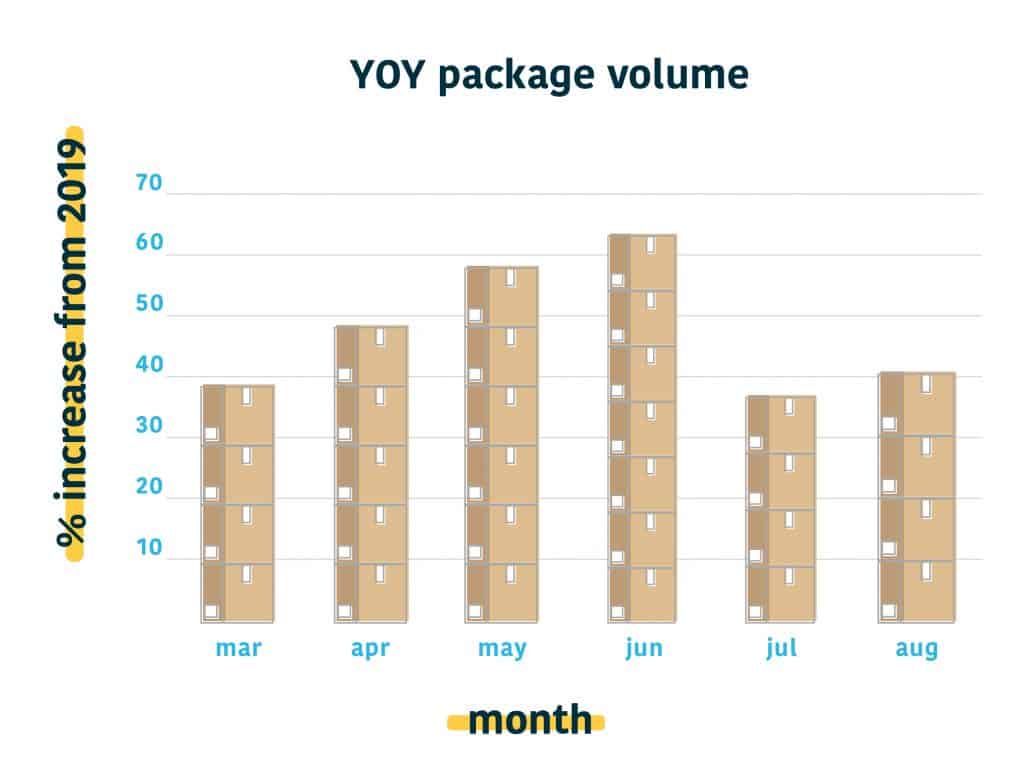

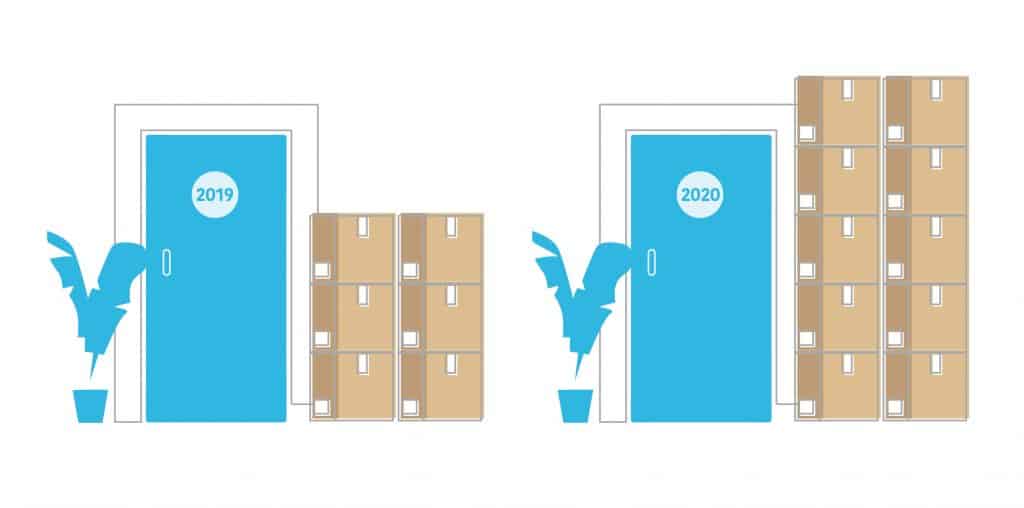

From June of 2019 to June 2020, package volume per unit at multifamily communities served by Fetch increased by 59%. In May, Fetch users at those properties averaged more than 10 package deliveries per apartment home, surpassing online holiday shopping levels from 2019. The average for July and August 2020 has been hovering around the 10 packages mark as well, at 9.79 and 9.83 packages, respectively.

So, what has that unprecedented package volume meant at the property level?

subscribe to our newsletter to stay up to date with multifamily projections and news

Volume, Oversized Packages Push Storage Limitations

It only takes one couch or king-sized mattress to clog a package room.

While the percentage of all packages that qualify as oversized – those measuring more than 4 cubic feet – remained consistent during the first six months of the pandemic, the overall volume increase means that oversized package volume has gone up at a similar rate.

Oversized packages make up only 5% of the total Fetch package volume, compared to 35% for envelope-sized deliveries and 60% standard parcels, but their impact has been felt recently.

Fetch delivered 6,813 oversized packages in April, but that number jumped by 68% in May to 11,477. Large package numbers climbed by another 16.53% in June and went up by an additional 2.44% in July. By mid-summer, oversized package volume increased to more than 200% of what it had been just three months ago.

The new package flow has surpassed the capacity of most multifamily properties and put a strain on thinly stretched on-site teams who were already taxed with trying to keep business running while managing through the ever-changing pandemic guidelines. The glut of online orders has also forced many properties without off-site package solutions to decline oversized packages or risk alienating residents by ceasing acceptance of package deliveries altogether.

How bad is the problem?

To put things in perspective, let’s assume that the average leasing office size is roughly 800 cubic feet – wall to wall, floor to ceiling.

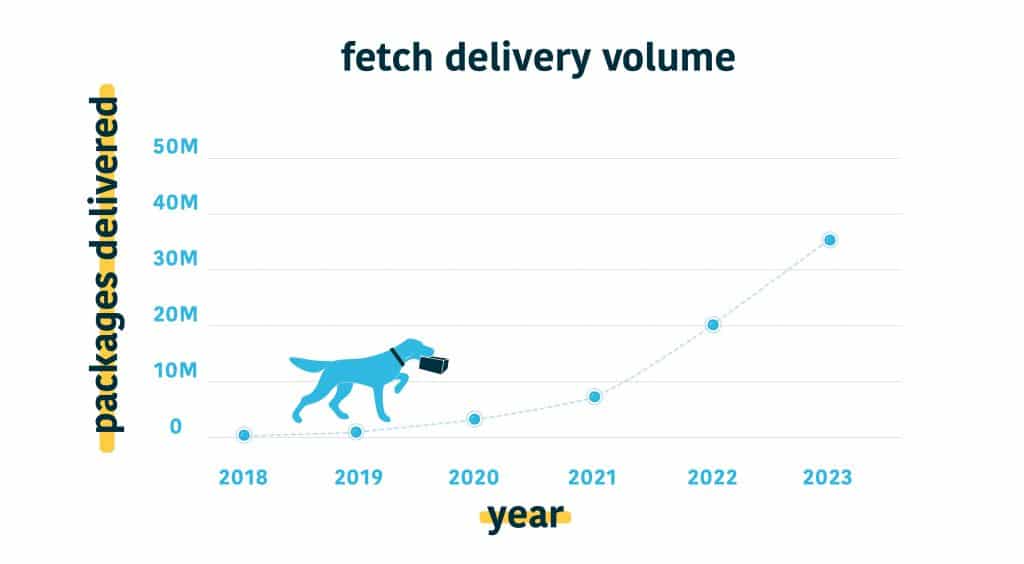

Next year, projections indicate that Fetch will handle approximately 11,304,190 cubic feet of packages. That’s enough to fill the typical leasing office to the rafters more than 14,130 times. Extrapolated data predicts that Fetch’s multifamily package volume will more than double by 2022 to 26,898,393 cubic feet – which could pack 33,623 leasing offices. By 2023, package volume will reach an estimated 47,882,270 cubic feet, or enough Fetch deliveries to bury more than 59,853 leasing offices.

Now, imagine walking into one of those leasing offices and trying to find your desk.

Also, keep in mind that these projections are only looking three years into the future. The package volume trajectory is eye-opening. E-commerce will inevitably reshape the way apartment communities handle the receipt and distribution of residents’ online purchases, and the change is coming sooner than later.